Making a car insurance claim

Making a claim on your car insurance shouldn’t be so hard that you need a manual to get through it, but accidents happen – and if one ever happens to you, we’re here to make sure you’re not left tearing your hair out.

Take it easy on yourself by following our step-by-step guide to making a claim. At Sheilas’ Wheels, our claims team deals with this stuff every day, so put yourself in their hands and let them take the strain. Read on, or click the image below to watch our handy video on YouTube.

Step 1. Call it in

Your first call should be for help if anyone is injured. Call the emergency services and follow any instructions they give you over the phone, and when they arrive on the scene.

Once everyone is safe, give us a call. Our Claims Specialists are trained to help Sheilas in distress and know exactly what questions to ask and what reassurance you’ll need. (You should call to report the accident whether you want to make a claim or not.) As well as giving you peace of mind, we’ll remind you what details we need and the next steps to take. We’ll talk you through your car insurance cover and any excess you may need to pay. And we’ll look at any additional cover you may have too, such as Car Hire Cover, Motor Legal Protection or Personal Injury Benefit.

If yours was the only car involved, you can report it online if you like, by logging in to My Account on the Sheilas’ Wheels website. Once complete, we’ll get in touch with you at a convenient time to go through the claim.

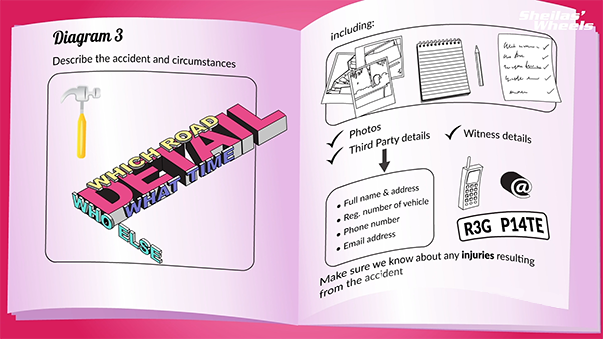

Step 2. Gather details

The more information you can give us about the incident, the easier it will be for us to settle your claim quickly and with the best possible outcome. The sort of details we need include:

- Drivers and passengers involved

- If there were witnesses

- What happened

- Where the accident was

- And when

- Photos of the damage to the vehicles involved

Before any of the other drivers, passengers or witnesses leave the scene of the accident, make sure you’ve got all their details. Start with the other drivers involved and ask for their:

- Full name

- Address

- Registration number

- Phone number

- Email address

Step 3. Assessing the damage

Once you’ve registered your claim and all the details, our damage assessors will go to work. They’ll look at any photos you’ve shared with us or arrange to have one of our approved repairers check over your car.

They’ll figure out how bad the damage is and explain to you what will happen next. Your car may be sent for repair, “written off” (deemed a total loss) as beyond repair, or another resolution that we’ll talk you through. If the car can be repaired, we’ll put you in touch with our approved repairers, who are tried and trusted at carrying out this sort of work for Sheilas’ customers.

Step 4. Settling the claim

While the damage is being assessed, we’ll be getting in touch with all third parties involved in the accident to piece the claim together and get you to the best possible outcome. If anyone gets in touch with you about the accident, just pass them on to us so we can deal with their questions for you so you don’t need to worry about that hassle.

You can get updated on the progress of the claim as often as you’d like, by text, phone or email, whichever you prefer. We’ll let you know what’s happening, how it was resolved, and let you know if it made a dent in your no claim discount. (If you got No Claim Discount Protection with your policy then your NCD won’t take a knock when your car does.)

Step 5. Further services

Depending on your level of cover, you may be entitled to a courtesy car while yours is being fixed. If so, our claims team or repairers will sort it out for you.

Some Sheilas take out Motor Legal Protection, which is one of our Optional Extras, that covers the legal fees (up to £100,000) for recovering any uninsured costs arising from a car accident. These might include personal injury compensation, alternative travel costs or loss of earnings – things that aren’t covered by the insurance policy. If you have Motor Legal Protection, we’ll appoint a solicitor to recover these costs, if needed.

Step 6. Closure

And that’s that. You can put the whole incident behind you and move on. Every claim is different. Some take longer than others but however complex your claim is, we’re here to help make the process be as painless as possible. With Sheilas’ Wheels, you’re in safe hands.

If you need to make a claim on your Sheilas' Wheels Car Insurance policy, visit our page for more details.

You might also be interested in…

How to make sure your wheels stay covered

Did you know there could be times when your car cover may not apply? Fortunately our helpful caddy is here to help you understand when these might be.

Making a home insurance claim

We know it’s frustrating when domestic bliss is interrupted and you have to make a claim on your home insurance.

We'd really like to hear your views

Let us know how we’re doing – after all what matters to you, really does matter to us.