FCA changes to insurance and how they may affect your premium

FCA changes to insurance and how they may affect your premium

The Financial Conduct Authority (FCA) – an insurance industry regulator – recently introduced new regulation to insurance pricing to take effect on 1 January 2022.

When it comes to generating a renewals premium for an existing customer, the regulation states that it mustn’t be higher than a new quote for a new customer. This assumes that:

• All the policy cover details are the same

• The way the policy was bought is also the same (e.g. a phone sale premium may be different from one you got through a price comparison website)

Sheilas' Wheels is fully supportive of these changes, so you can be assured that your renewal quote will always be the same or less than an equivalent new customer quote, assuming all the information available to calculate the quote (including cover details and sales channel) is the same.

Other changes made by the FCA include:

• The option to stop your cover renewing automatically, at any time and at no extra cost

• Providing more clarity about premium finance costs (full payment vs direct debit) and the difference between those two options (including the charge for interest and the premium finance agreement needed to pay monthly)

You may find your premium has gone down this year

There are a few reasons why this may be a little or a lot, including:• If you’ve made changes to your policy in the past year

• The way we rate your insurance risk

• How we’ve adjusted premiums this year so you don’t pay more with us than an equivalent new customer would

Naturally, your cover will stay the same (subject to any underwriting changes – see the ‘Renewal Update’ page in your renewal pack) and will still be Defaqto 5 Star rated.

You may have expected your premium to have gone down this year

If the price you pay for your policy hasn’t gone down (or only a bit), it’s because your premium is already in line with our new business pricing.You may discover your premium has gone up this year

The premium we quote reflects all kinds of things, including:• FCA regulation changes

• Changes in the market

• Changes to how we rate your insurance risk

• Changes you may have made to your policy during the past year

You may wonder if you’ve been overpaying for your insurance previously

What you paid at the time was correct for your specific policy and period of cover.When we generated the renewal premium(s) for your previous year(s), we’d have considered a few factors. These would have been the same for all customers and included:

• Our risk on the policy at that time

• The level of cover you asked for

• Market pricing

To find out more about the FCA pricing regulation and how the changes affect insurance please go to fca.org.uk

You might also be interested in

Home Insurance - what's your type?

Check out the different types of cover we offer in our handy video

Protect your home now - and chill when it's chilly

Here's some simple ways to prepare your home inside and out for the season ahead

Thinking about a new set of wheels?

Our article takes you through the things to consider when buying a new (or used) car

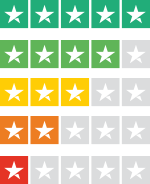

We'd really like to hear your views

Let us know how we’re doing – after all what matters to you, really does matter to us.