PREMIUM

The amount paid by you (the policyholder) to us (the insurer)

INSURANCE SCHEDULE

One of the main documents you receive when you take out a policy, with all your details and the info about what’s covered and what terms there are (like Excesses and Endorsements - eyes peeled for those, below…). It’s super-important to check that all details you’ve supplied are right, as if they’re not it could mean your insurance isn’t valid and could be cancelled.

EXCESS

The amount of money you’d need to pay the insurer towards the total cost of a claim if you had to make one, over and above your premium. There’s two main types:

- Compulsory excess is set by the insurer and can’t be changed by you

- Voluntary excess is an additional amount that you can offer to pay (if you want to) and you can choose the amount

Generally, if you have a higher voluntary excess your Premium will be lower. Don’t forget, if the worst should happen and you have to make a claim you’ll need to pay the total excess amount (Compulsory plus Voluntary), so make sure it’s an amount you can afford. Both amounts will be in your Insurance Schedule, as well as any other excess amounts, as some are different for different types of claims (like a windscreen claim).

UNDERWRITER

Individuals or companies who help insurers work out the risk they’re taking, and then how much your Premium will be. This is based on lots of clever things like how old your car is, what’s its value, how do you use it, and have you got any speeding fines or other convictions.

ENDORSEMENT

Any amendment to the standard terms in the policy booklet that applies to only you and your policy, not everyone else. These are shown in your Insurance Schedule and can include things like if your policy doesn’t include cover for driving other cars.

EXCLUSION

Something not covered by our standard policy – things like damage caused by pets while they’re in your car for example (so don’t let Fluffy scratch your leather seats!). We list them all in your policy booklet under the headings ‘What is not covered’, and ‘General exclusions which apply to this policy’.

LIABILITY COVER

Cover that pays out for the costs to repair damage to other people’s cars, or medical expenses if any people involved are injured, if you’re found to blame (or ‘liable’) in an incident with another person.

TOTAL LOSS

When your beloved motor is damaged so badly that it would cost more to repair than to replace it (AKA ‘totalled’ or ‘written off’).

NO CLAIM DISCOUNT

A discount that you usually get on your Premium if you haven’t made any claims on your insurance each year. Sometimes it’s called a ‘No Claim Bonus’ too.

USAGE CLASS

The different ways someone uses their car. It’s one of the things that’s looked at when working out your Premium, as different usage classes carry different risks. These include:

- Social, Domestic and Pleasure, for everyday things like popping to the shops, driving to a friend's house etc.

- Commuting, for when you also drive to and from the same place of work every day

- Business use, for if you use your car to visit clients or drive to more than one office

It also includes whether it’s just you or other people driving the car.

HIRE OR REWARD

Using your car to make money, so if you decide to become a taxi driver, or start delivering pizzas for the local takeaway. It’s different from the other Usage Classes and isn’t covered by a standard policy, so if you do decide to use your motor to make some extra cash, you’ll need to get specialist cover.

GAP INSURANCE

Short for ‘Guaranteed Asset Protection’ insurance, which pays the difference (or ‘gap’) between a pay-out you receive from your insurance company after a total loss or stolen and not recovered claim, and the value of the car when it was bought. It tends to be talked about for new cars more, but it is available for second hand cars under 7 years old too.

MARKET VALUE

How much you’d expect to get if you sold your car on the open market right before you had your accident or loss (remember that Total Loss definition? Scroll up if you need to). Look at what vehicles of the same make and model, similar age, condition and mileage are currently selling for to work this out.

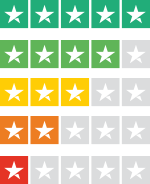

DEFAQTO

Defaqto is a leading financial information, ratings and fintech business. Its Star Ratings help consumers make better informed financial decisions. They give our Car Insurance a 5 Star Rating, just so you know ?

So, now you’ve had a good peek under the bonnet of some common insurance terminology, hopefully things are a little bit clearer when you’re checking your policy, or looking at different parts of your cover. For more jargon-free information and tips, check out our

Content Garage.

Go back